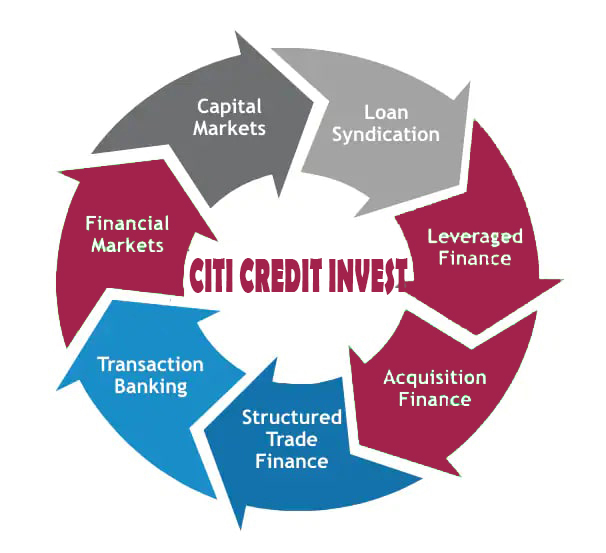

Services

Offering bespoke services to our clients

CITI Credit Invest Bank’s global multi-product platform provides client-led and customized solutions

Your banking partner for international trade flows

With a focus on large corporations, governments, banks, investors and development organizations, our presence in the London enables us to better serve our UK's client base by facilitating trade and investment flows between the Americas, Asia, Africa, the Middle East and Europe.

Products and Solutions we offer across our network

Supporting your cash management needs

| EASY COLLECTIONS | ENHANCED LIQUIDITY | EFFICIENT PAYMENTS |

- Multiple Electronic collections methods across channels

- Virtual Accounts supporting multi currency

- Various Collection Points

- Solutions for trapped liquidity

- Increased visibility to optimise your processes and improve strategic decision making

- Yield enhancement

- Specialised Treasury Solutions

- Full suite of unique local payment solutions

- Dedicated workflows for time critical payables

- Virtual Accounts solutions available to help reconcile payables

- Integrated FX payments for seamless workflow

Supporting your trade and working capital requirements

| DOCUMENTARY TRADE | OPEN ACCOUNT | SUPPLY CHAIN FINANCE |

- Letter of credit issuance, advising, negotiation, discounting, and confirmation services

- Import and export documentary collections including discounting of avalised bills (subject to avalising jurisdiction).

- Financial Institution trade loans

- One-stop guarantee programme for BGs/SBLCs issued within our network for faster turn around for issuance

- Import and export invoice financing

- Receivables services

- Pre-shipment finance

- Borrowing-based trade loans

- Financing the suppliers and distributors based on client’s credit standing

- Enables more favourable purchase terms from suppliers

- Easier access to financing for the suppliers and distributors

- Unlocks cash from clients receivables and distributors with extended credit terms

Managing market volatility in your markets

Count on our full suite of financial market solutions for your complete hedging, investment and funding needs

| RATES AND FX | STRUCTURING | RESEARCH |

The Bank continues to break new ground in our markets, delivering products including:

- FX forwards, non-deliverable forwards, options, index products and e-commerce

- Broad Interest Rate product suite

- Our structuring teams work with clients on their hedging, investment and funding requirements

- Dedicated resources provide full coverage to onshore sales and facilitate deal discussions with client

- A team of economists cover macro and FX trends across our markets

- Dedicated rate strategists provide market updates and trade ideas

- Our credit team covers over 300 sovereign, corporate and financial sector credits across Asia, Africa and the Middle East

KEY DIFFERENTIATORS

- Provide access to over 100 emerging market and G10 currencies

- Pioneer in interest rate and cross currency swaps in Asia, Africa and the Middle East

- Broad range of credit products to assist clients in managing credit risk exposures or in enhancing investment yields

- Industry specialists and dedicated on the ground teams across our footprint markets

Providing you with easy online access

Manage your transactions and accounts anywhere, anytime through our single sign-on, multi-lingual, global platform

Private Banking NextGen

| FEATURES |

| Intuitive dashboard which provides a comprehensive view of accounts and activities; allowing you to make informed, real-time decisions |

| Simplified user interface that enables you to navigate and complete tasks faster and with ease |

| Customizable view for dashboard and certain payment functions to cater to your needs |

| Improved client self-administration for more effective and efficient implementation of user permissions and authorization matrices |

| Business intelligent analytics to help drive better efficiency such as recommended payment types based on your payment requirements | |

| Designed for mobility to provide a seamless user experience in terms of accessibility and interface across devices |

| Flexible integration options through APIs or ERP systems |

| Cyber security biometrics which include the use of mobile tokens to access and perform transactions with greater convenience |